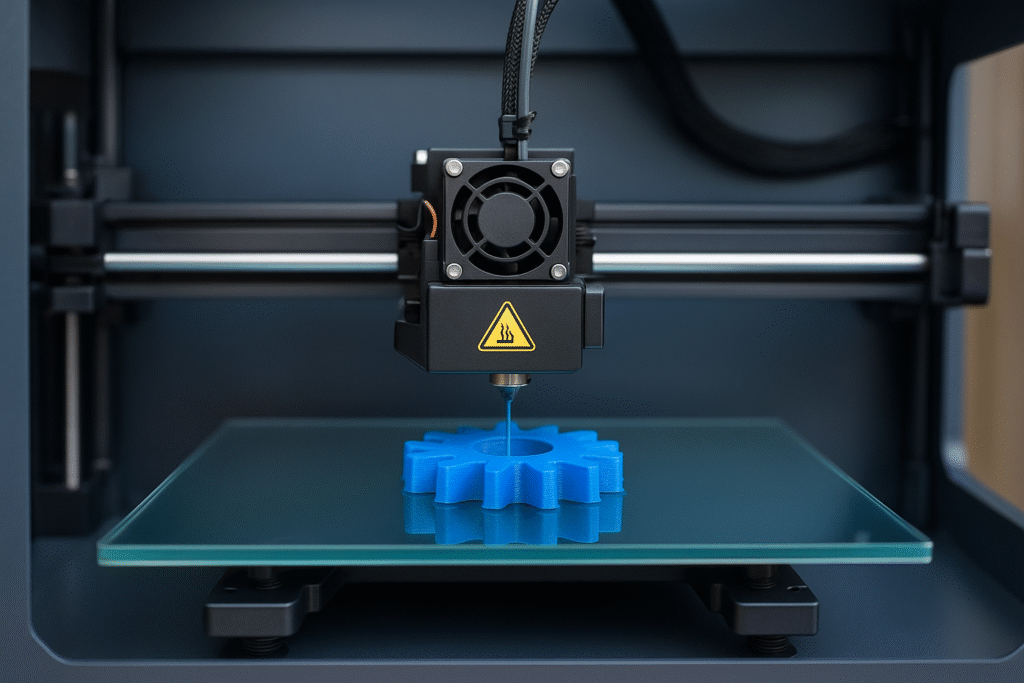

Customs compliance for 3D printer imports: essential trade rules

For companies importing additive manufacturing equipment, customs compliance for 3D printer imports has become a crucial step in international trade. Demand for these devices has expanded rapidly, and customs authorities now require importers to meet strict regulations. By following the right rules, businesses can avoid penalties, shipment delays, and unnecessary costs.

HS code classification and tariffs

The foundation of compliance lies in accurate HS code classification. Most 3D printers fall under HS code 8477, which defines machinery for processing plastics and similar materials. However, some hybrid devices that include 2D printing functions may require different codes, which directly impact tariff rates. Misclassification often triggers customs disputes, so businesses must double-check product details before declaring imports.

FCC certification for wireless-enabled printers

Another critical aspect is certification. Printers that include wireless connectivity such as Wi-Fi or Bluetooth must comply with FCC regulations. Importers need to ensure that the manufacturer has obtained an FCC Registration Number, a grantee code, and proper testing by an accredited laboratory. Even when printers lack wireless features, customs may request supporting documents to prove compliance, making preparation essential.

Documentation and clearance strategy

In addition to HS classification and FCC rules, accurate documentation is vital. Commercial invoices, packing lists, and certificates of origin form the core of customs compliance for 3D printer imports. Missing or incomplete paperwork is among the most common causes of clearance delays. By working with experienced customs brokers and using digital trade tools, importers can reduce risks and ensure smoother cross-border operations.

Why compliance strengthens trade reliability

Ultimately, businesses that prioritize compliance gain more than just legal security. They build stronger relationships with customs authorities, improve delivery reliability, and protect their reputation with global partners. In this way, customs compliance for 3D printer imports becomes not just a regulatory obligation but also a long-term advantage in an increasingly competitive industry.

Fuente: Beeontrade